Joint life insurance policy for couple...how beneficial?

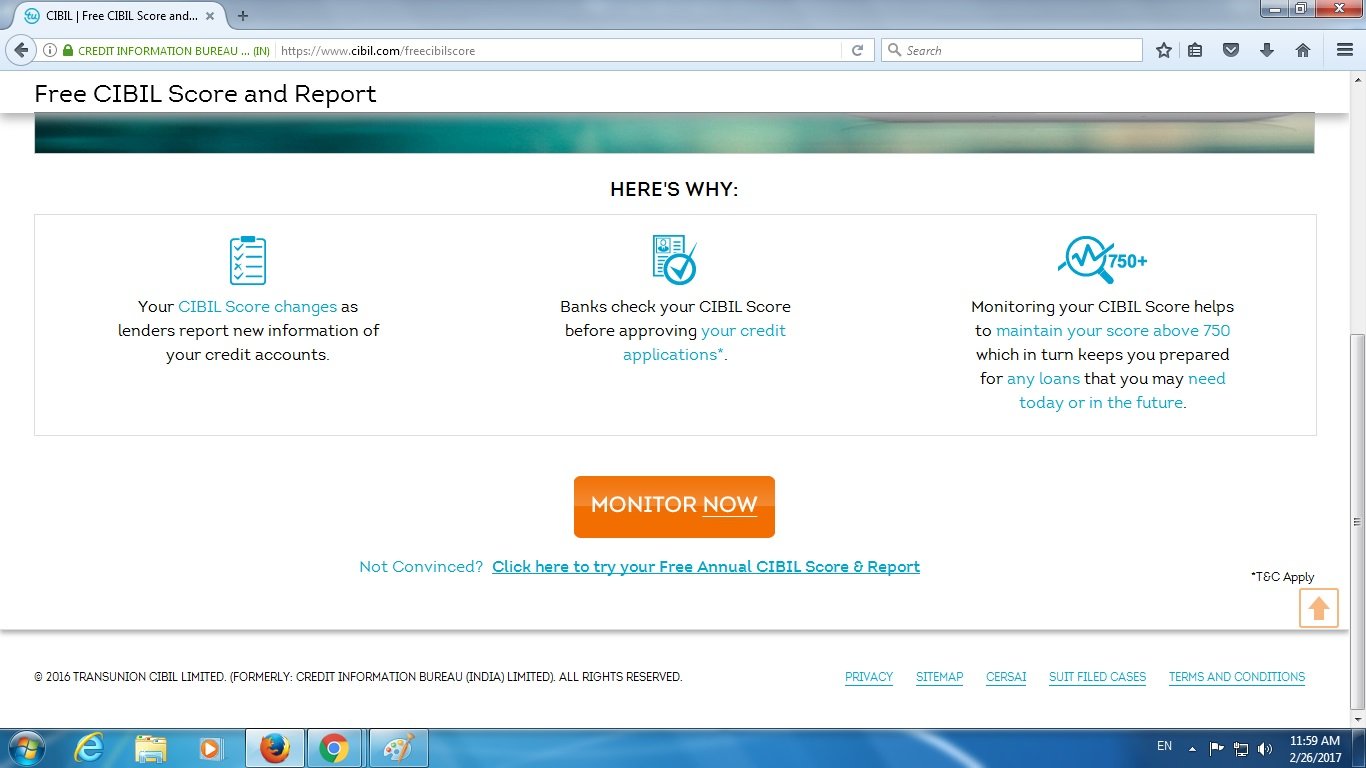

Credit Insurance Bureau of India Ltd., (CIBIL) score shows the history of your loaning and repaying habits. Banks and financial agencies will check your CIBIL score before sanctioning any loan. This has to be checked at least once a year. CIBIL has created an opportunity for us to check our score online, free of cost, once a year. Let us see how it is done. Until now you could know your CIBIL score only if your pay a fee. But now, Reserve Bank of India (RBI) has ordered all credit companies to hand over CIBIL score or report on history of loans of customers, free of cost, online, once a year, without fail. For this, you will have login at https://www.cibil.com/freecibilscore. Next click on 'Free Annual CIBIL Score Report' button, at the bottom of the page.

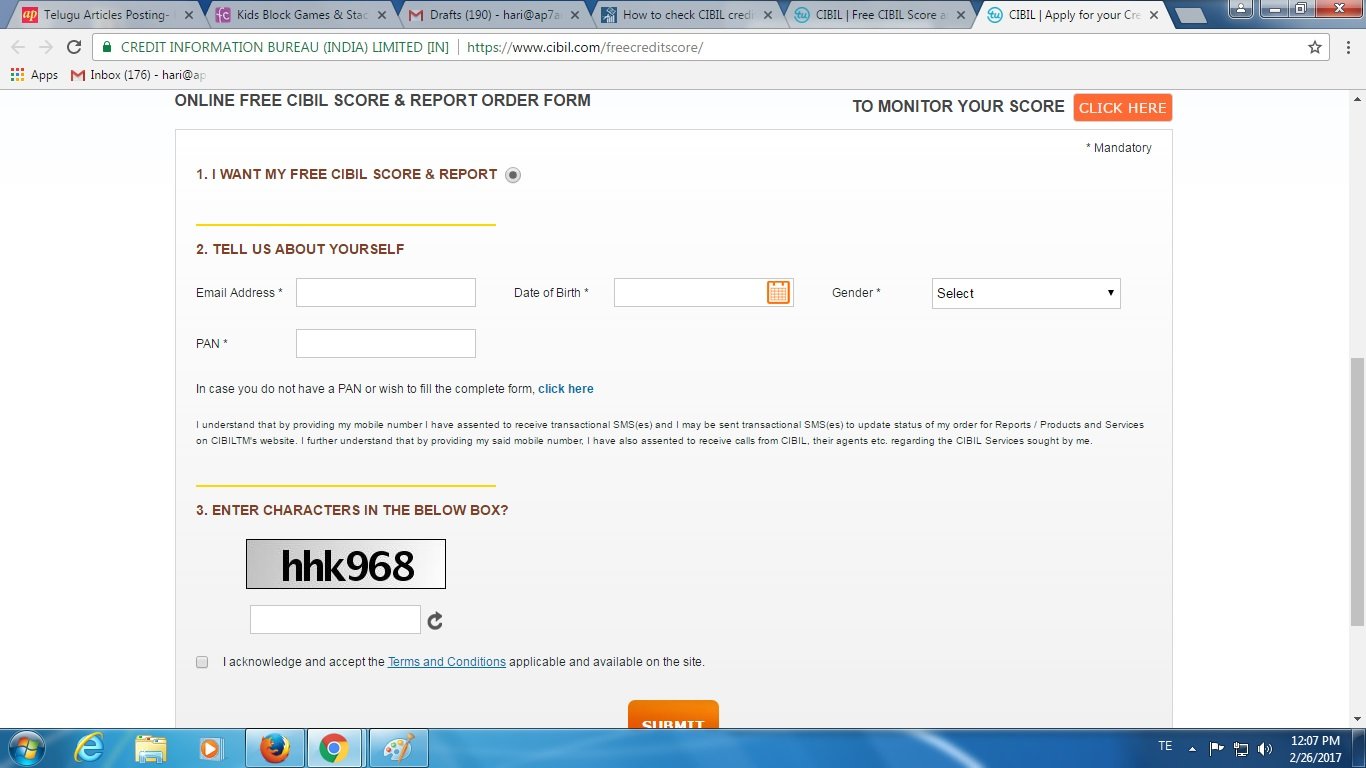

Until now you could know your CIBIL score only if your pay a fee. But now, Reserve Bank of India (RBI) has ordered all credit companies to hand over CIBIL score or report on history of loans of customers, free of cost, online, once a year, without fail. For this, you will have login at https://www.cibil.com/freecibilscore. Next click on 'Free Annual CIBIL Score Report' button, at the bottom of the page. You will be taken to the next page, where you will have to provide email ID, date of birth, gender and pan number. Next fill in the captcha and tick agree to rules and regulations, before clicking submit button.A page with details of how much to pay for CIBIL score reports will show up. Paid membership schemes will be seen. Here click 'No Thanks' button. A page with the message 'Authentication Successful' will appear. A prompt asking you to login at My CIBIL will show up. Login details will be sent to your mail ID. My CIBIL page link and one time password will be sent.

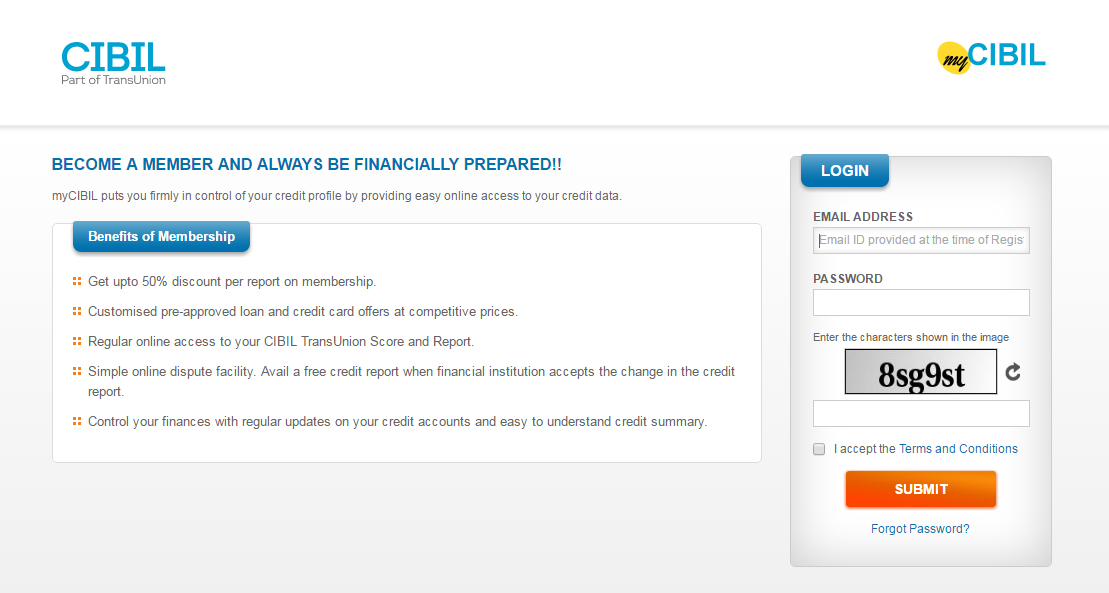

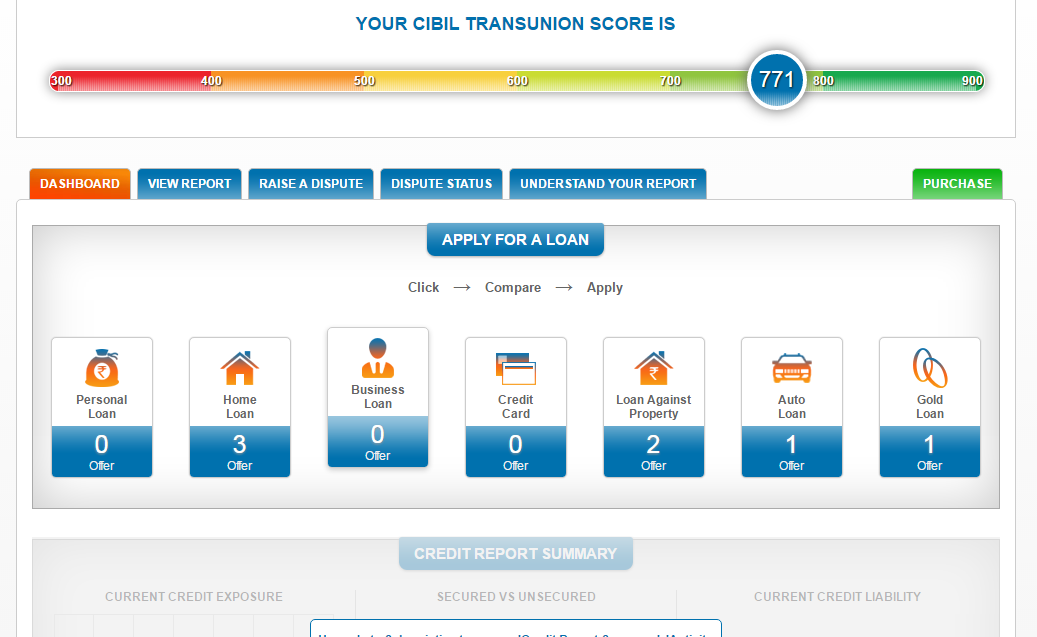

You will be taken to the next page, where you will have to provide email ID, date of birth, gender and pan number. Next fill in the captcha and tick agree to rules and regulations, before clicking submit button.A page with details of how much to pay for CIBIL score reports will show up. Paid membership schemes will be seen. Here click 'No Thanks' button. A page with the message 'Authentication Successful' will appear. A prompt asking you to login at My CIBIL will show up. Login details will be sent to your mail ID. My CIBIL page link and one time password will be sent. Login to My CIBIL with these details. Immediately a new page will appear asking to set a new password. Set a new password and login at My CIBIL page. The home screen will appear as above. The top corner will show your score. Several options will be seen, below this. In View Report option, personal details, contact number, account details (present as well as past loan history), details of the companies that have asked to view your CIBIL score will be seen.

Login to My CIBIL with these details. Immediately a new page will appear asking to set a new password. Set a new password and login at My CIBIL page. The home screen will appear as above. The top corner will show your score. Several options will be seen, below this. In View Report option, personal details, contact number, account details (present as well as past loan history), details of the companies that have asked to view your CIBIL score will be seen.

About CIBILCIBIL

started in the year 2000 to learn about the loaning habits of the people in the country. There are other companies like Equifax and Experian that do the same service as CIBIL. They keep a record of the loans taken and repayments done by customers, by securing the details of loans and repayments through credit cards. These companies keep giving the details of those who have taken loans from banks and credit companies, repayments and details of defaulting on loans repayments, to CIBIL. In this manner, each one's score and report are maintained. How credit score can be damagedIf repayments are not made, cheques bounce, in case of failure to pay credit card bills, credit cards taken on unsecured loans. excess of personal loans, signing as witness for another, escaping when that person fails to pay up, utilising fully the limit on credit cards, affect CIBIL score.

How credit score can be damagedIf repayments are not made, cheques bounce, in case of failure to pay credit card bills, credit cards taken on unsecured loans. excess of personal loans, signing as witness for another, escaping when that person fails to pay up, utilising fully the limit on credit cards, affect CIBIL score.

How to increase the score

Paying credit card bills, not defaulting on Easy Montly Installments (EMI), paying before or within the due date without fail, posting cheques at least 10 days early so that they get cleared within the due date or make payment within due date, even if they bounce, will help give a good score. Do not take a lot of loans at one time. Several companies will give excess amounts or more than one loan to those who have a good CIBIL score. However, beware before availing these loans. Do not take many loans, like personal loans, credit card loans or such other unsecured loans. See that you take not more than two loans at a time. Do not forget to take 'no due' certificate from banks or finance agencies, after the entire loan amount is cleared. Make sure that there is at least six months gap between clearing of one loan and taking of another.

Do not take a lot of loans at one time. Several companies will give excess amounts or more than one loan to those who have a good CIBIL score. However, beware before availing these loans. Do not take many loans, like personal loans, credit card loans or such other unsecured loans. See that you take not more than two loans at a time. Do not forget to take 'no due' certificate from banks or finance agencies, after the entire loan amount is cleared. Make sure that there is at least six months gap between clearing of one loan and taking of another.

Let it be anyone, relatives, friends or others, do not sign assurance for their loans. Do not use the entire amount under credit card loan. This is called Credit Utilisation Ratio. It means using a part of the approved loan amount. Try to resolve any issue regarding repayments immediately.

Credit card history has a great impact on CIBIL score. For example: If you are entitled for Rs. 50,000 credit on your card, it is not wise to use the entire amount every month. At the same time, to use up to 80 per cent is ok. If you need more than that, increase your card limit and use less. It is convenient to use 30 to 40 per cent of credit limit. Even not using one of the cards, when you have two cards, impacts CIBIL score adversely. If you have no credit card, taking one and making payments through it will give you a good credit history.

If you have to clear loan amounts or fines for delayed payments or unpaid interests, it is better to pay it back. CIBIL score will improve with secured loans like Housing loans. Adversely, attractive car loans, personal loans and credit card loans, will impact CIBIL score.

Credit Score

It will show the repayment capacity. If a person takes a loan, will he be able to repay it or not? This question is answered by Credit Score. CIBIL score report will show if anyone has defaulted on any loans or repayments were delayed.

If the score is between 750 to 900, it is considered an excellent score. It denotes a good history of repayment of loans. It gives an opportunity to avail bank loans at convenient rates of interest. Credit score will show to which kind of loan the customer is eligible. In My CIBIL account you can check out which loans are ready to be offered.

A score of 700-750 is considered as good. A score of 550-700 is less. This problem occurs due to not repaying recent loans on time. Even financial agencies will think about giving loans to those with such scores. Even if they lend, it will be at high interest rates. If the score is less than this, it is difficult to get loans.